You’ve heard the term, maybe even seen it tacked onto your lease agreement, but when it comes to the real cost of renters insurance: factors affecting price & how to save, many people are surprised by just how affordable and essential this protection truly is. Forget the notion that insurance is always a hefty expense; for renters, it’s one of the most budget-friendly safeguards you can invest in, offering substantial peace of mind for mere dollars a month.

Far from being a luxury, renters insurance is a fundamental safety net, designed to shield your financial well-being from unexpected disasters like theft, fire, or even a clumsy guest. But what exactly influences its price tag, and more importantly, how can you ensure you’re getting the best possible deal without sacrificing crucial coverage? Let’s break down the mechanics of renters insurance pricing and arm you with the strategies to save.

At a Glance: Key Takeaways on Renters Insurance Costs

- Affordable Protection: Renters insurance is typically optional and one of the most affordable types of insurance, averaging around $148 per year ($12/month).

- Core Coverage: Basic policies protect personal belongings against damage/theft, provide liability coverage for accidents, and cover additional living expenses if your rental becomes uninhabitable.

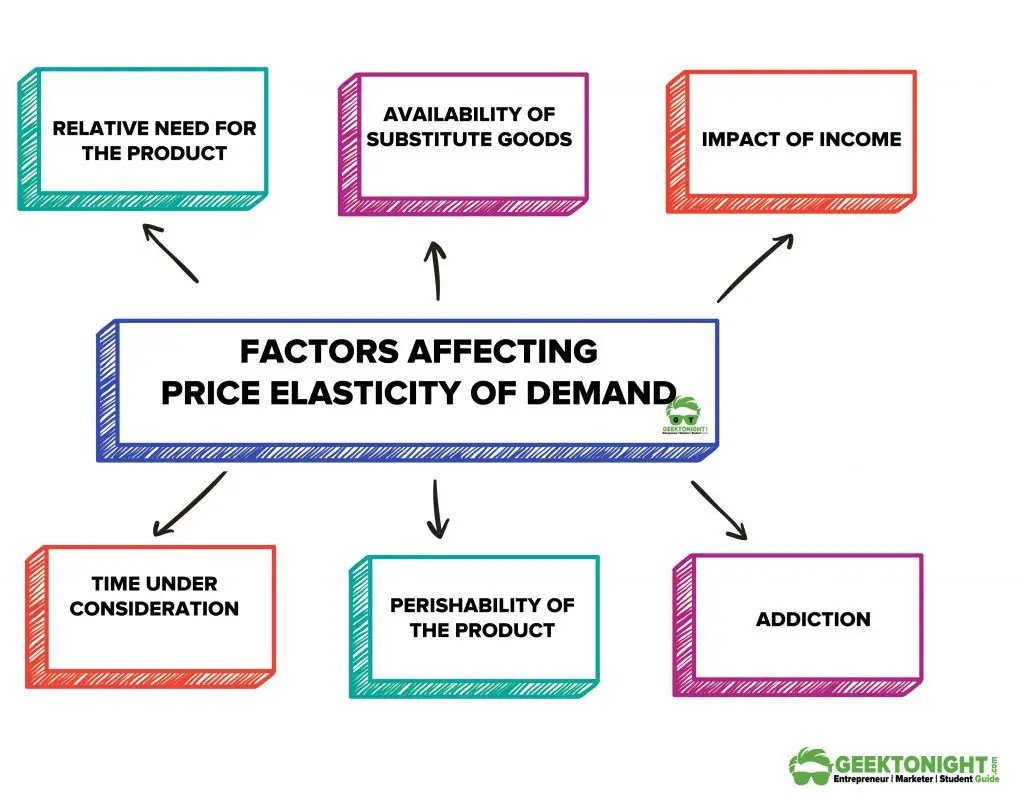

- Price Influencers: Your location, chosen coverage limits, deductible amount, the safety features in your home, and even your claims history all play a role.

- Smart Savings: Bundling policies, increasing your deductible, maintaining good credit, and shopping around are effective ways to lower your premium.

- High Value: For a modest monthly fee, you gain protection against losses that could easily amount to tens of thousands of dollars.

Understanding the Renters Insurance Equation: What You're Actually Buying

Before we dive into the numbers, it’s crucial to understand what renters insurance is—and what it isn't. Unlike homeowners insurance, your renters policy isn't designed to protect the physical structure of the building you live in. That's your landlord's responsibility. Instead, renters insurance focuses entirely on you and your life within that rental space.

A standard renters insurance policy typically comes bundled with three primary types of coverage:

- Personal Property Coverage: This is the core protection for your belongings. Think about everything you own – furniture, electronics, clothing, jewelry, kitchenware. If these items are damaged, destroyed, or stolen due due to a covered peril (like fire, smoke, theft, vandalism, certain weather events), your policy steps in. You’ll generally choose between two valuation methods:

- Actual Cash Value (ACV): Pays out the depreciated value of your items, meaning what they’re worth today after wear and tear. This is cheaper but offers less reimbursement.

- Replacement Cost Coverage (RCC): Pays to replace your damaged or stolen items with brand-new ones, without accounting for depreciation. This offers superior protection but can add 10-20% to your premium.

Most basic policies start with $15,000-$25,000 in personal property protection, but you can adjust this based on the value of your possessions.

- Liability Coverage: This is where the policy truly shines in safeguarding your financial future from unexpected accidents. If a guest trips and falls in your apartment, gets injured, and decides to sue for medical bills, your liability coverage will help cover their costs and any associated legal fees. It also protects you if you accidentally damage someone else's property, even if it's outside your rental unit (e.g., your dog chews up a friend's valuable rug). Standard liability is often $100,000, but increasing it to $300,000 or $500,000 usually adds only a minimal amount to your annual premium, offering significantly more peace of mind.

- Loss of Use (or Additional Living Expenses - ALE) Coverage: Imagine a fire or severe pipe burst makes your apartment unlivable. Where do you go? Loss of use coverage helps pay for temporary accommodation, meals, and other essential living expenses (like laundry services) while your home is being repaired or you're finding a new place. This coverage is typically a percentage (10-20%) of your personal property limit and is invaluable when your life is unexpectedly uprooted.

These three pillars form the backbone of a renters insurance policy, providing comprehensive financial protection for a remarkably modest cost.

The Surprising Sticker Price: Why Renters Insurance is So Affordable

If you've ever braced yourself for the cost of home or auto insurance, the price tag for renters insurance often comes as a pleasant surprise. This isn't a premium that will break your budget; in fact, it's one of the most budget-friendly forms of insurance available.

The average cost of renters insurance hovers around $148 per year, which breaks down to a mere $12 per month. While most renters typically pay between $15 and $30 per month, the annual budget range for a basic policy is generally between $120-$180. Even for those with higher-value belongings or more extensive coverage needs, premiums rarely exceed $600 annually.

Consider this: the average renter owns personal property valued anywhere from $20,000 to $30,000. A single theft or fire incident could result in losses dozens of times greater than your annual premium. The liability protection alone could save you tens or even hundreds of thousands of dollars in legal fees and medical bills if an accident occurs. When you weigh the minimal monthly cost against the substantial financial risks it mitigates, renters insurance quickly reveals itself as an exceptional value proposition.

Decoding Your Premium: The Factors That Move the Needle

While the average cost provides a good benchmark, your specific premium will be tailored to your unique circumstances. Several key factors influence how much you'll pay. Understanding these can empower you to make informed choices and potentially lower your rate.

Where You Live Matters: Location, Location, Location

Your geographic location is arguably one of the most significant determinants of your renters insurance premium. Insurers assess risk based on your zip code, taking into account several variables:

- Crime Rates: Urban areas with higher rates of theft or vandalism typically see higher premiums than rural areas, where crime statistics tend to be lower.

- Natural Disaster Risk: If you live in a region prone to specific natural disasters—think coastal areas susceptible to hurricanes, states in "Tornado Alley," or earthquake zones—your premium will reflect that elevated risk. For instance, states like Louisiana, Florida, and Mississippi often have higher rates due to hurricane exposure, while Oklahoma, North Dakota, and Iowa tend to have lower average costs.

- Local Claim Frequency: Insurers look at how often claims are filed in your specific area. A neighborhood with a history of frequent property damage or theft claims will likely have higher rates.

- Proximity to Fire Departments: Living closer to a fire station or within a well-equipped fire district can sometimes lead to lower rates due to faster response times and reduced damage potential.

The Big Decisions: Coverage Limits and Deductibles

The choices you make about how much coverage you want and how much you're willing to pay out-of-pocket if you file a claim (your deductible) directly impact your premium.

- Coverage Limits: Opting for higher personal property coverage (e.g., $50,000 instead of $15,000) or increasing your liability coverage from $100,000 to $300,000 will naturally increase your premium. Remember, choosing Replacement Cost Coverage over Actual Cash Value for your personal property also typically adds 10-20% to the cost, but it's often a worthwhile upgrade for better reimbursement.

- Deductibles: Your deductible is the amount you pay yourself before your insurance coverage kicks in. Common options range from $250 to $2,500, with $500 or $1,000 being frequent choices.

- Higher Deductible = Lower Premium: If you choose a higher deductible (e.g., $1,000 instead of $250), your monthly premium will be lower. This is because you're taking on more of the initial financial risk.

- Lower Deductible = Higher Premium: Conversely, a lower deductible means higher monthly payments but less out-of-pocket expense when you file a claim.

The key is to select a deductible you can comfortably afford to pay at a moment's notice, without putting your emergency savings at risk.

Built-in Protection: Safety Features and Building Type

Your rental unit's inherent safety features and the building's construction can make a difference in your rates. Insurers reward properties that demonstrate a lower risk of claims.

- Safety Devices: Installing or living in a unit equipped with smoke detectors, carbon monoxide detectors, burglar alarms (especially those monitored by a central station), deadbolt locks, or sprinkler systems can often qualify you for discounts ranging from 5-15%.

- Building Materials: Homes made of fire-resistant materials like brick or concrete are generally considered less risky than those constructed primarily of wood, potentially leading to lower premiums.

- Community Features: Living in a gated community, a building with a doorman, or one with secure access controls can also signal lower risk to insurers.

- Age and Condition: Older buildings, particularly those with outdated electrical or plumbing systems, might pose higher risks and thus command higher premiums.

Your Past Catches Up: Claims History

Just like with auto insurance, your claims history impacts your renters insurance rates. If you've filed multiple claims in the past, especially within a short period, insurers may view you as a higher risk and charge a higher premium. Conversely, a long history of being claim-free can sometimes earn you loyalty or claims-free discounts.

The Financial Footprint: Credit Score

In many states (though not all, as some states prohibit its use for insurance rating), your credit score can influence your insurance premium. Insurers often use a credit-based insurance score as a predictor of how likely you are to file a claim. Generally, a lower credit score can lead to higher premiums, while improving your credit can help lower costs by 20% or more. This makes another compelling case for maintaining good financial health.

Beyond the Basics: Optional Add-Ons

While standard coverage is robust, you might have specific needs that require additional protection, which can increase your premium. These add-ons are entirely optional but can provide crucial coverage for unique circumstances.

- Scheduled Property Riders: For particularly valuable items like high-end jewelry, art, musical instruments, or collectibles that exceed your standard personal property limits, you might need a "rider" or "endorsement." This schedules the specific item for its full appraised value.

- Natural Disaster Coverage: Standard policies usually cover fire, wind, and hail. However, specific perils like earthquakes or floods are typically excluded and require separate add-on coverage or a different policy altogether.

- At-Home Business Riders: If you run a small business out of your rental, your standard policy might not cover business equipment or liability related to your commercial activities. An at-home business rider can extend protection.

- Identity Theft Riders: These can provide financial assistance for expenses incurred while recovering from identity theft, such as legal fees or lost wages.

These add-ons typically cost an extra $25-$100 annually per rider, depending on the item or coverage type.

Smart Strategies to Slash Your Renters Insurance Bill

Now that you understand what goes into your premium, let's talk about proactive steps you can take to lower your costs without compromising on essential protection. Saving money on renters insurance is often simpler than you think.

1. Bundle Your Policies

This is one of the easiest and most effective ways to save. Many insurance providers offer significant discounts when you purchase multiple policies from them. Combining your renters insurance with your auto insurance is a classic move, and it can often save you between 5-25% on both policies, potentially adding up to $50-$200 or more annually. If you have other insurance needs, like motorcycle or boat insurance, inquire about bundling those too.

2. Increase Your Deductible (Wisely)

As discussed, opting for a higher deductible will lower your monthly premiums. If you have a robust emergency fund – enough to comfortably cover a $500, $1,000, or even $2,500 deductible – choosing a higher option can save you a noticeable amount over the year. Just be honest with yourself about your financial capacity; you don't want to be caught off guard if you do need to file a claim.

3. Choose the Right Amount of Coverage

Under-insuring your belongings leaves you vulnerable, but over-insuring means you're paying for protection you don't need. Take the time to create a detailed home inventory of your possessions. Use photos or videos, list purchase dates and estimated values. This not only helps you determine an accurate personal property coverage limit but also simplifies the claims process if disaster strikes. Work with an insurance agent to ensure your limits accurately reflect your needs without excess.

4. Boost Your Home's Safety Features

Even in a rental, you can often implement or benefit from safety features. Discuss with your landlord about installing deadbolts or even a simple security system. Many apartments come with smoke detectors, but if you add extra fire extinguishers or a smart home security system, be sure to inform your insurer. These proactive measures can lead to discounts ranging from 5-15%.

5. Maintain Good Credit

If you live in a state where credit scores are used for insurance rating, a strong credit history can significantly reduce your premiums. Insurers view individuals with higher credit scores as more financially responsible and, statistically, less likely to file claims. Improving your credit score can translate into savings of 20% or more on your renters insurance.

6. Pay Annually

Most insurers offer a discount if you pay your entire annual premium upfront, rather than opting for monthly installments. This saves the insurance company administrative costs associated with processing monthly payments, and they pass a portion of those savings on to you. This simple change can save you $25-$50 per year by avoiding those processing fees.

7. Shop Around, Every Year

Insurance rates are not static, and they vary significantly between providers. What was the best deal last year might not be this year. Make it a habit to get quotes from at least three different insurance companies annually. This ensures you're always getting competitive pricing and that your current insurer isn't quietly increasing your rates without justification. Online comparison tools make this process quick and easy.

8. Seek Out Additional Discounts

Don't be shy about asking your insurance agent about any other discounts you might qualify for. These can include:

- Loyalty Discounts: For remaining with the same insurer for several years.

- Claims-Free Discounts: For not filing a claim for a certain period.

- Professional or Group Discounts: Some insurers offer special rates for members of certain professional organizations, alumni associations, or even for teachers or military personnel.

- Senior Discounts: For renters over a certain age.

A quick conversation with your agent could uncover savings you didn't even know existed.

The True Value: More Than Just a Policy, It's Peace of Mind

At its core, renters insurance offers profound financial protection for a modest investment. When you consider that a single theft or fire incident could result in personal property losses averaging between $20,000 and $30,000, and that liability claims could easily reach tens or even hundreds of thousands of dollars, the annual premium of $120-$180 looks like a bargain.

This isn't just about covering your material possessions; it's about insulating your financial life from unforeseen catastrophes. Without renters insurance, you’d be solely responsible for replacing all your belongings out of pocket, a financial burden that few individuals could comfortably bear. You'd also be personally liable for any injuries sustained by a guest in your home or damage you accidentally cause to someone else's property. The absence of this protection could lead to significant debt, legal battles, and immense stress.

The peace of mind that comes with knowing your assets are protected and your liability is covered is invaluable. For the cost of a few cups of coffee each month, you're securing your financial stability against a range of common perils. To dive deeper into this decision, you can learn if renters insurance is worth it and explore its full spectrum of benefits.

Quick Answers to Your Renters Insurance FAQs

Navigating the world of insurance can bring up specific questions. Here are some common queries about renters insurance:

Is Renters Insurance Legally Required?

Typically, no. Renters insurance is usually optional, though some landlords or property management companies may require it as a condition of your lease agreement. Even if not required, it's highly recommended for the financial protection it offers.

Does Renters Insurance Cover Roommates?

Generally, no. A standard renters insurance policy covers the named policyholder and usually immediate family members living in the same household. Roommates who are not family members would typically need to purchase their own individual renters insurance policies to protect their personal belongings and liability. It's crucial to clarify this with your insurer.

What About Natural Disasters Like Floods or Earthquakes?

Standard renters insurance policies do cover many natural disasters like fire, windstorms, and hail (though hurricane damage might have a separate deductible in high-risk areas). However, major natural disasters like floods and earthquakes are almost universally excluded from standard policies. If you live in an area prone to these specific risks, you would need to purchase separate flood insurance or an earthquake endorsement (rider) to your policy.

How Do I Determine How Much Personal Property Coverage I Need?

The best way is to create a comprehensive home inventory. Walk through your rental and list every item, from major furniture and electronics to clothing, kitchenware, and valuables. Estimate their current replacement cost. There are many free apps and online templates available to help with this. Don't forget to photograph or video your belongings and keep receipts for valuable items. This detailed inventory will not only help you choose the right coverage limit but also expedite any potential claims.

Your Next Steps: Securing Your Peace of Mind

You now have a comprehensive understanding of how renters insurance costs are determined and a powerful arsenal of strategies to save money. The next logical step is to put this knowledge into action.

- Inventory Your Belongings: Start by creating that home inventory. It’s the foundation for making informed decisions about your personal property coverage.

- Gather Quotes: Don't settle for the first offer. Reach out to at least three different insurance providers – both large national carriers and smaller regional ones. Many offer online quote tools that can give you an estimate in minutes.

- Inquire About Discounts: As you get quotes, specifically ask about bundling options, safety feature discounts, loyalty discounts, and any professional or group affiliations you might have.

- Review Your Options Carefully: Compare not just the premium, but also the coverage limits, deductibles, and any exclusions. Understand the difference between Actual Cash Value and Replacement Cost Coverage and choose what's right for you.

- Revisit Annually: Make it a habit to review your policy and shop for new quotes once a year. Your belongings change, your financial situation evolves, and the insurance market shifts. A quick annual check-up ensures you're always getting the best value for your protection.

Renters insurance isn't just another bill; it's an investment in your financial security and peace of mind. By understanding its real cost and leveraging smart savings strategies, you can protect your world without straining your budget.